Draft IR35 legislation published: a summary of the key changes

In the wake of the government’s recent IR35 private sector consultation, the Finance Bill was released on 11 July 2019 and included the final draft legislation for the off-payroll rules that are coming into force from 6 April 2020.

It is broadly as anticipated, with no major changes to the proposals highlighted in the Autumn Budget 2018, but we’ve collated some of the main points of interest that we believe might affect our clients and contractors, along with some guidance that we hope you will find helpful.

Research shows that 45% of organisations are yet to address the issue and in the relatively short time before this comes into force, there is understandable concern from contractors that companies may hire fewer of them, as well as apprehension from organisations that contractors could walk away from those who don’t manage their IR35 processes well. With that in mind, here are some of the grey areas explained.

"Small" businesses

Companies or organisations that are deemed “small” are exempt from the changes and Chapter 8 of ITEPA 2003 (IR35) continues to apply. To be defined as small, a business must meet two of the following criteria in any given year:

- Annual turnover of less than £10.2 million

- Balance sheet total of less than £5.1 million

- Number of employees less than 50

Small group companies will also be exempt where they satisfy the definition set out in section 383 of the Companies Act.

Status determination

There is now more clarity around status determination statements, with HMRC confirming that it will also produce guidance to ensure that organisations can apply the rules correctly.

- The client must complete the statement, plus reasoning for transparency, communicating it to all parties down the contractual chain.

- Status decisions can be made on a group of workers with the same role, working practices and contractual conditions, however blanket ‘inside’ or ‘outside’ rulings cannot be made.

- Clients must introduce a status determination disagreement process – any disagreement raised must be responded to within 45 days and managed by the client as they are best placed to understand contractual terms and working practices of individuals it engages.

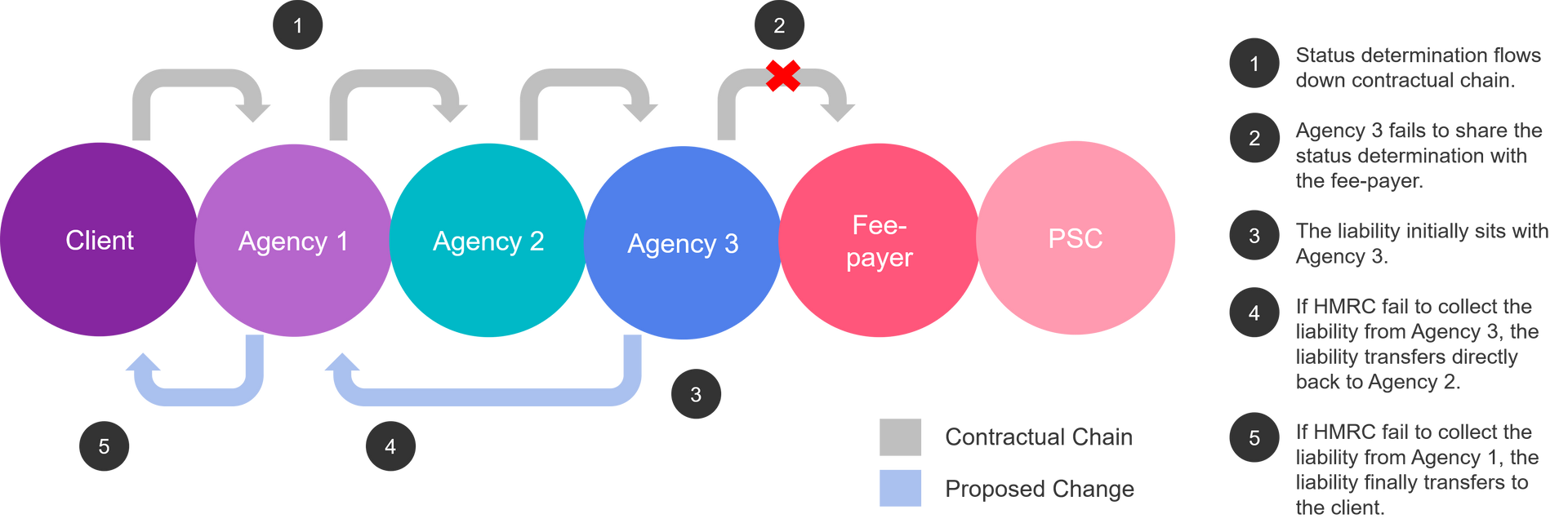

Liability

The fundamental chain of liability remains unchanged, so if the fee payer fails to deduct PAYE and HMRC cannot settle that PAYE liability, it will become the liability of the first agency and subsequently the client if the first agency is unable to settle the liability.

Though the government has stated that it’s not their intention to transfer liabilities in cases of genuine business failure, liability can also transfer to the client if:

- it does not comply with the status disagreement process;

- it doesn’t notify the chain of a change in its status to a small entity;

- HMRC is unable to collect unpaid tax and NICs from the fee payer or “Agency 1” (often an RPO or MSP).

The result of this should be that clients are likely to take much more interest in the compliance of their supply chain.

Offshore

If a fee-payer is offshore, liability moves to the next UK entity above them in the contractual chain, right back to the client if they are the only UK party involved. Tax and NICs must be paid if a worker provides services in the UK, whether or not any parties are outside of the UK.

Outsourced/consultancy services

Where a client buys an outsourced service, they will not need to consider the employment status for tax purposes of any of the workers provided as part of that outsourced supply. The provider of the outsourcing will, in effect, become the client for the purposes of the off-payroll rules.

Our advice for our clients:

- Don’t wait for the 2019 Autumn Budget to act. Poor, last-minute decisions can be avoided by addressing IR35 now.

- We believe that economic forces will drive the outcome: companies who want to bring in the skills they need to deliver value will be flexible and will offer genuine service based outside IR35 contracts.

- Consider every element of your contractual chain to ensure all parties are compliant.

- Given the right approach and planning, it is perfectly possible to maintain a flexible workforce post-April 2020.

- Contact us for advice and support and keep an eye out for our upcoming guide and client events in the coming weeks and months.

Our advice for contractors:

- Educate yourself on the changes and be prepared. Consider the possible implications of working for a single client; using client equipment; or managing client employees as part of your work.

- Genuine contractors who engage with the businesses that they work for should be able to ensure that they retain their flexible status.

- Reach out to us for any advice, use our expertise, watch our webinar, or download our guide.

Get in touch

Please provide your details and submit the form below - we'll be in touch shortly.